Read Unity's financial report

Runtime Fee will be introduced in Unity

Update: Unity withdrew some of the changes.

It has been announced that Runtime Fee will be introduced to Unity from 2024/01. Unlike the previous billing model, the fee is based on the number of game installations, which has been opposed by developers.

Unity Software Inc was listed on the NYSE in 2020/08. The financial reports are also publicly available. I've read it this time.

Unity Overview

Unity was originally founded in Denmark. Closer to it, Spotify was founded in Sweden and Skype was founded in Luxembourg by a Dane and a Swede.

Unity is a game engine, and developing on this platform allows you to deliver games that run on different game consoles, smartphones, etc. The image is that developing on the wrapper is less labor intensive than developing individually. Competitors include Unreal Engine and Godot Engine.

The company's history began when the original game GooBall was not a commercial success. The company pivoted to selling the in-house tools it used to develop the game. Riccitiello, formerly of Electronic Arts, replaced co-founder David Helgason as CEO in 2014.

They are active in M&A. In 2014, they acquired Applifier, Playnomics, and Tsugi, becoming Unity Ads, Unity Analytics, and Unity Cloud Build. In 2019, Vivox, deltaDNA , ChilliConnect, Obvioos, and Artomatix were merged. MLAPI and RestAR were in 2020. Pixyz Software, Parsec, and Weta Digital were in 2021. Ziva Dynamics and ironSource were in 2022.

That's a lot. We need to separate operating income because of the cost of acquisitions.

Unity is already a profitable structure on a quarterly basis

Now let's look at the financial reports.

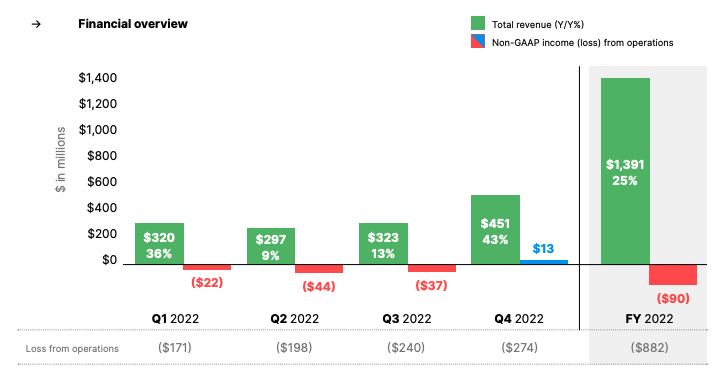

Annual deficit structure until 2022 is shown in the 2022 Q4 financial reports. It turned profitable in 2022 Q4.

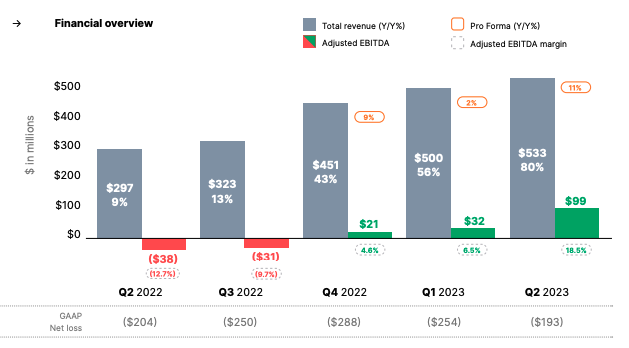

The latest quarterly report also shows an increase in profit.

Unity usage fees will increase by about 20% from 2022/10, so perhaps that is the reason for the increase.

Unity's Business Model

Unity has three revenue streams at the time of the IPO. 54% is from Operating Solutions, consisting of Unity Ads and Unity In-App Purchases. 31% is from Create Solutions, which consists of Unity Engine royalties. 15% is from strategic partnerships and other sources.

Meta was also heavily affected by Apple's restrictions on opt-in of IDFAs (ad identifiers) starting with iOS 14.5 in 2021/04, and there is a possibility that they leveraged others because they were concerned about the future of Unity Ads. In fact, Unity stock crashed 37% in 2022/05 due to IDFAs.

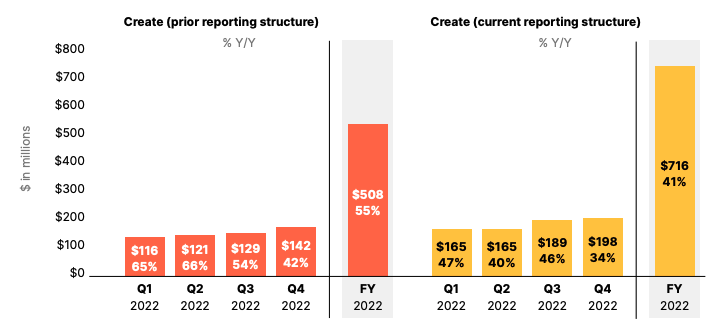

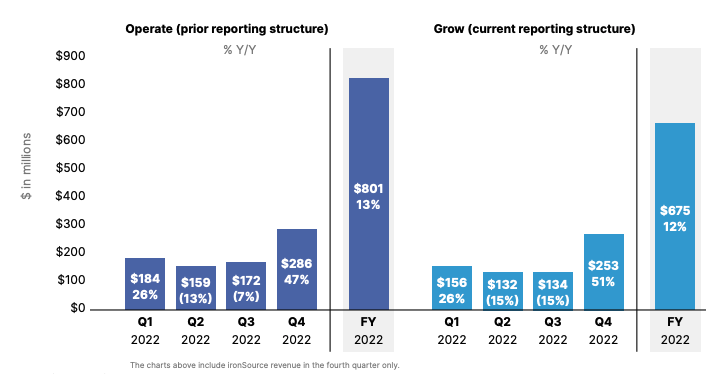

The reporting format has changed since the 2020 IPO. Create Solutions are Create Solutions and Unity Gaming + Strategic Partnerships, which was formerly in Operate Solutions. Grow Solutions include Ads products, Supersonic, Aura, and Luna. Create $508M in the old format, Operate $801. So as a percentage, it hasn't changed from the IPO. I thought there would be more of an IDFA impact.

Hypercasual games are competing with Unity

Here's the complicated part. ironSource and Supersonic were merged in 2015. The merged ironSource was acquired by Unity in 2022. Supersonic is a growth platform, but also publishes its own hyper-casual games. Tall Man Run and Basket Battle are ranked #2 and #5 in the 2022 Hyper Casual Ranking.

According to the 2023Q2 financial reports, the company has already published 90 games.

The newly announced Runtime Fee for Unity is calculated based on the number of installations, so games like hypercasual, which have a low unit cost and are widely installed, seem to be at a disadvantage.

The sales of the games themselves included in Unity's Grow Solutions are not detailed. So it is unclear, but if hyper-casual games are a gold mine as a genre and if hyper-casual games can be easily created using Unity, it is reasonable for the company to make it structurally difficult for other games to be released.

Upselling of existing customers is slowing

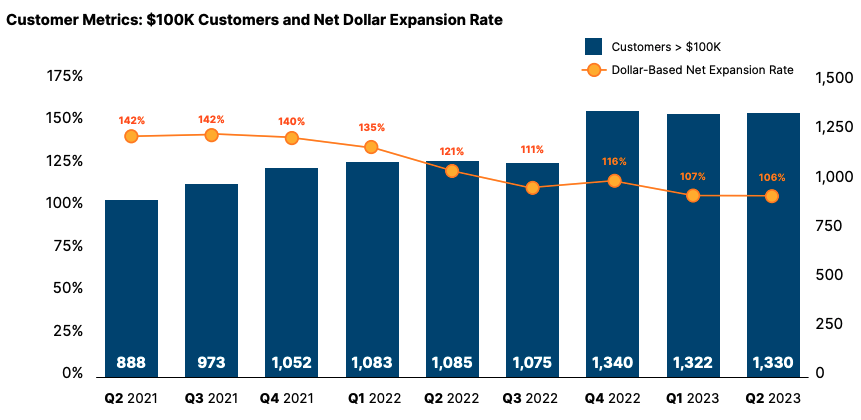

The IR material shows the number of customers and Dollar-Based Net Expansion Rate (DBNER: sales growth rate per existing customer).

The number of customers is increasing, but upsells are slowing.

Summary

- Unity is aggressively acquiring.

- However, upselling has not been successful for the additional features

- Reliance on advertising is a business risk due to IDFA restrictions on iOS

- Recent acquisitions have brought not only game engines but also hyper casual games themselves into the portfolio

So, I thought (delusionally) that it would have been reasonable to make the pricing plan disadvantageous to other hypercasual games by way of an alternative upsell. There is a lot of speculation, so I hope it reads like a conspiracy theory on the back of a flyer.

Comments

The FORM S-1, which is the first part (Japanese IPO format) of the US market, is also available and I would like to read that as well.

Not directly related to Unity, but in connection with Scandinavia, The Playlist, based on the story of Spotify's founding, was interesting to see how the founder, who came from an engineering background, worked.